|

NEW JERSEY STATUTE

DEFINITION WHAT IS A HOTEL

NJ Realtors Report

Negative Impact of Taxing Tourists

June 1, 2007

Other States Seasonal Rental Tax

NJ #1 Tax Increasing State in the

Nation, Again

STATE TAKING BACK TOURISM PROMOTION DOLLARS

GOVERNOR TO RAISE TAXES EVEN HIGHER

A NEW TAX

MUNICIPAL PARKING FEES

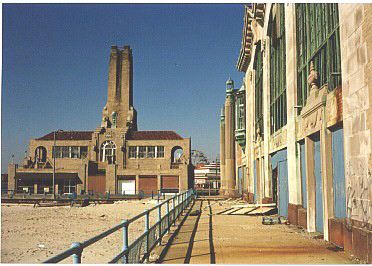

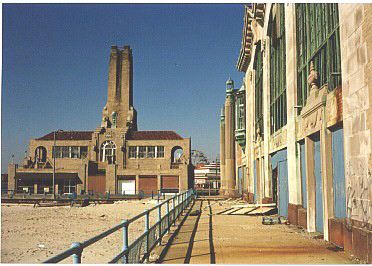

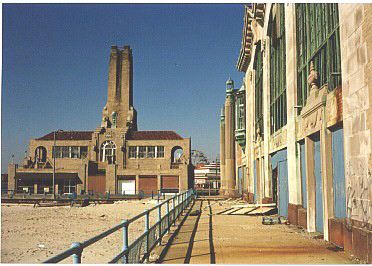

ASBURY SCENARIO

MOTEL CRISIS

POINT PLEASANT BEACH NJ

State Of NJ Div. of Taxation Investigates Seasonal Rental

Owners

03/20/05 COMPLIANCE AND COLLECTION

UNDERWAY

NJ League of Municipalities Targets

Seasonal Rental Homes, Condo's for Taxation

BILLS & SPONSOR to

Reduce Tax

The Law Synopsis

P.L.2003, c.114

Assembly Bill 3710

12/5/04

Increase

taxes including occupancy taxes

POST YOUR OPINION

ASBURY SCENARIO

TOURISM FAILURE

NEWS PAGE

Jersey Shore Links

Avon

Belmar

Bradley Beach

Cape May

Point Pleasant Bch

Tourism Information

Chamber of Commerce

Seaside Heights

Seaside Height BID

Spring Lake

Long Beach Island

Southern Ocean Chamber of

Commerce

Manasquan

Wildwood

| |

MARCH 20, 2005

State Of NJ Div. of Taxation Investigates

Seasonal Rental Owners

COMPLIANCE AND COLLECTION UNDERWAY

State of New Jersey Division of

Taxation has launched an investigation into the practices of all individuals

(Private home owners, Realtors, anyone) who offers their properties for rent for

less than 90 days.

The Tax Laws of the State of

New Jersey Requires All Individuals to Register and Collect Sales Tax and

Occupancy Tax if Renting Properties for less than 90 Days.

However owner of homes and other residential rental

properties have operated for years under the assumption that those rentals

had no obligation to collect a tax.

The State at the present time is not

offering an amnesty program and has otherwise embarked upon an enforcement

and collection approach on a case by case basis.

New Jersey Sales Tax Guide Click for NJ Div. of Taxation Guide

Sales Tax Law

The New Jersey Sales and Use Tax Act imposesa tax of 7% upon

the receipts from every retail sale of tangible personal property, digital

property,and the sale of certain services, except as otherwise

provided in the Act. .... In addition,most services performed upon

tangible personal property are taxable unless they are specifically

exempted by law. Exempt items include:most food sold as grocery

items, most clothing and footwear, disposable paper products for household

use, prescription drugs, and over-the counter drugs.

This means that in New Jersey, most items and most services performed upon

tangible personal property are taxable unless they are specifically exempted

by law.

Hotel tax enabling Language

...There

is imposed and shall be paid a hotel and motel occupancy fee of 7% for

occupancies on and after August 1, 2003 but before July 1, 2004, and of 5% for

occupancies on and after July 1, 2004, upon the rent for every occupancy

of a room or rooms in a hotel subject to taxation pursuant to subsection

(d) of section 3 of P.L. 1966, c.30 (C:54:32B-3), which every person

required to collect tax shall collect from the customer when collecting the rent

to which it applies...

From

the most recent Bulletin

S&U-4

http://www.state.nj.us/treasury/taxation/pdf/pubs/sales/su4.pdf Pg 28

"Tourism-related sales. include the following (if also taxable

under the Sales and Use Tax Act):

Hotel, motel, or boarding house,

lodging;"

|

1. |

a small,

makeshift or crude shelter or habitation, as of

boughs, poles, skins, earth, or rough boards;

cabin or hut.

|

|

2. |

a house used as a temporary

residence, as in the hunting season.

|

|

4. |

a house or cottage, as in a park

or on an estate, occupied by a gatekeeper,

caretaker, gardener, or other employee.

|

|

5. |

a resort hotel, motel, or inn.

|

|

6. |

the main

building of a camp, resort hotel, or the like.

|

|

7. |

the meeting

place of a branch of certain fraternal

organizations. |

|

8. |

the members

composing the branch:

The lodge is planning a picnic. |

|

9. |

any of

various North American Indian dwellings, as a

tepee or long house.

Compare

earth lodge. |

|

10. |

the Indians

who live in such a dwelling or a family or unit

of North American Indians. |

|

11. |

the home of

a college head at Cambridge University, England.

|

|

12. |

the den of

an animal or group of animals, esp. beavers.

|

–verb (used without

object)

|

13. |

to have a

habitation or quarters, esp. temporarily, as in

a hotel, motel, or inn:

We

lodged in a guest house. |

|

14. |

to live in rented quarters in

another's house:

He lodged with a local family

during his college days. |

|

15. |

to be

fixed, implanted, or caught in a place or

position; come to rest; stick:

The bullet lodged in his leg. |

–verb (used with

object)

|

16. |

to furnish

with a habitation or quarters, esp. temporarily;

accommodate:

Can you lodge us for the night? |

|

17. |

to furnish with a room or rooms

in one's house for payment; have as a lodger:

a boardinghouse that lodges oil

workers. |

|

18. |

to serve as

a residence, shelter, or dwelling for; shelter:

The château will lodge the ambassador during his

stay. |

|

19. |

to put,

store, or deposit, as in a place, for storage or

keeping; stow:

to

lodge one's valuables in a hotel safe.

|

|

20. |

to bring or

send into a particular place or position. |

|

21. |

to house or

contain:

The spinal canal lodges and protects the spinal

cord. |

|

22. |

to vest

(power, authority, etc.).

|

|

23. |

to put or

bring (information, a complaint, etc.) before a

court or other authority. |

|

24. |

to beat

down or lay flat, as vegetation in a storm:

A

sudden hail had lodged the crops. |

|

25. |

to track (a

deer) to its lair.

|

[Origin:

1175–1225; ME logge <

OF loge < ML

laubia, lobia; see

lobby ]

lodge·a·ble,

adjective

|

Pronunciation

Key

-

Show Spelled Pronunciation[loj]

Pronunciation Key

-

Show IPA Pronunciation

noun, verb,

lodged, lodg·ing.

Pronunciation

Key

-

Show Spelled Pronunciation[loj]

Pronunciation Key

-

Show IPA Pronunciation

noun, verb,

lodged, lodg·ing.

![]()